Facing an insurance dispute can be stressful. It often involves complex procedures and legalese that read more can leave you feeling overwhelmed. However, by following a clear step-by-step guide, you can successfully navigate this process and maximize your chances of a favorable outcome.

- Initially, carefully review your insurance policy documents to understand your protection. Identify the specific terms that relate to your dispute and any relevant exclusions.

- After this, gather all supporting documentation, including medical records, invoices, and communications with the insurance company.

- Meticulously document every interaction you have with the insurance company, noting dates, times, names of representatives, and the substance of conversations. This documentation will be invaluable if your dispute progresses to a higher level.

- Additionally, consider speaking with an insurance attorney or advocate. They can provide expert guidance on your rights and options, and help you structure a strong case.

Remember, persistence is key when dealing with insurance disputes. Continue organized, keep detailed records, and fight for your rights.

Winning Your Insurance Claim: Strategies for Success

Submitting an insurance claim can feel like a daunting task, but with the right strategies, you can maximize your chances of a successful outcome. First and foremost, thoroughly review your policy documents to comprehend your coverage limits and any specific requirements for filing a claim. Next, promptly report the incident to your insurer, providing them with all essential details in a clear and concise manner. Gather evidence to support your claim, such as photographs, repair estimates, or witness statements.

During the claims process, maintain open communication with your adjuster, answering their inquiries promptly and honestly. Be prepared to debate the settlement amount if you believe it is inadequate. Remember, patience and persistence are key to finalizing your claim successfully.

Understanding Insurance Claims: How to Avoid Common Pitfalls

Submitting an insurance claim can seem like a daunting task, but understanding the process and avoiding common pitfalls can maximize a smooth experience. First, meticulously review your policy documents to clarify your coverage limits and obligations. Next, promptly report the claim to your insurer, providing all necessary information about the incident. Be prepared to present supporting evidence, such as photographs or repair estimates.

- Refrain from exaggerating the damages to your claim.

- Maintain a detailed record of all communications with your insurer.

- Cooperate with the insurance adjuster throughout the procedure.

By following these tips, you can manage the insurance claims process with certainty and minimize potential issues.

Don't Settle for Less: Fighting Back Against Unfair Insurance Practices

You deserve reliable insurance coverage that exceeds your needs. Unfortunately, the insurance industry can sometimes feel like a labyrinth of confusing practices. When you encounter unfair treatment or suspicious tactics from your insurer, don't stay passive. Stand up for yourself

Insurance companies have a responsibility to operate ethically and fairly. They should provide clear policies, process claims effectively, and treat you with respect. If your insurer falls short of these standards, understand that you have rights.

* **Review Your Policy:** Carefully examine your insurance policy to verify you understand its terms and conditions.

* **Document Everything:** Keep a detailed record of all communication with your insurer, including dates, times, names, and conclusions.

* **Seek External Assistance:** If you encounter difficulties resolving the issue directly with your insurer, consider speaking with a consumer protection agency or an insurance ombudsman. They can provide advice and help you navigate your options.

Don't let unfair insurance practices slide by. Empower yourself with knowledge and take appropriate steps to safeguard your rights. Remember, you have the power to bring about improvement.

Exploring Your Rights: A Consumer's Guide to Insurance Disputes

When encountering an insurance dispute, it can feel daunting. Happily, you have certain rights as a consumer. Grasping these rights is crucial for resolving the situation proactively.

Initially, it's vital to carefully review your insurance policy. Pay close attention to the terms and conditions concerning claims, dispute resolution, and coverage. Document all correspondence with your insurance company, including dates, times, and details of conversations.

If you encounter difficulties resolving the dispute directly with your insurer, consider reaching out to an independent mediator. They can provide neutral support and help mediate a reasonable resolution.

Remember, you have rights as a consumer. Be educated of your options and don't to demand help when needed.

Insurance 101: Mastering the Art of Negotiation and Communication

When tackling insurance, effective communication and negotiation skills can profoundly impact your outcomes. Understanding the intricacies of your policy and assertively articulating your needs to insurance agents is essential. This article will guide you through key strategies for mastering these abilities, enabling you to tackle the insurance landscape with confidence.

- Cultivate a thorough understanding of your policy terms.

- Hone your communication techniques, focusing on conciseness.

- Investigate alternative options to optimize your coverage.

By implementing these strategies, you can effectively negotiate the best possible protection for your needs. Remember, knowledge is power in the world of insurance.

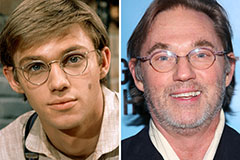

Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now!